Federal Tax Brackets 2025 Married Jointly

Federal Tax Brackets 2025 Married Jointly. For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the. The income thresholds for each bracket,.

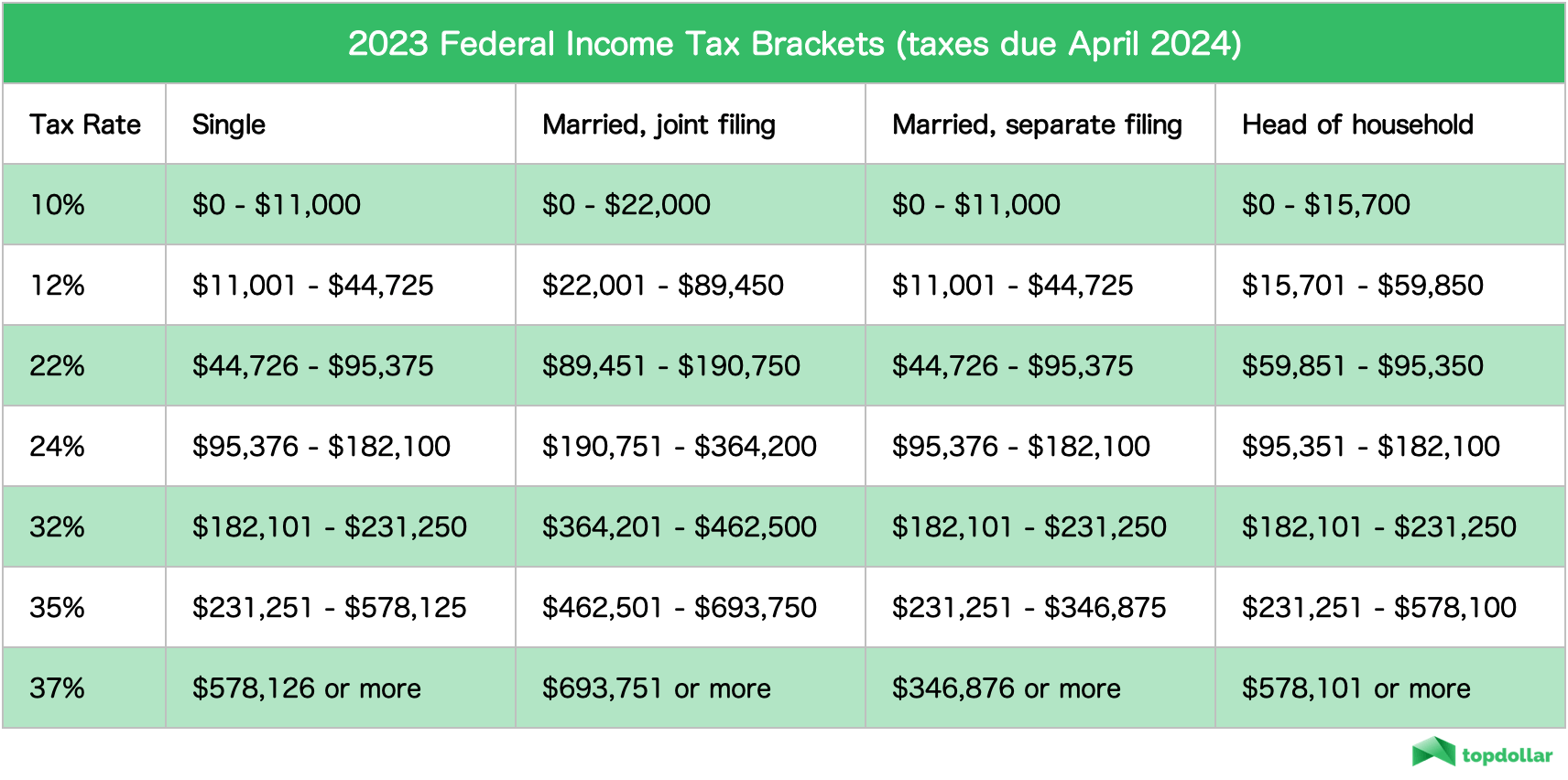

It’s never too early to start thinking about next year’s taxes. Tax brackets for income earned in 2023.

The Additional Standard Deduction Amount For An Individual Who Is Aged Or Blind Is $1,550.

The income thresholds for each bracket,.

For Both 2023 And 2025, The Seven Federal Income Tax Rates Are 10%, 12%, 22%, 24%, 32%, 35% And 37%.

The seven federal tax bracket rates range from 10% to 37% 2023 tax brackets and federal income tax rates.

Page Last Reviewed Or Updated:

Images References :

Source: bestfinanceeye.com

Source: bestfinanceeye.com

Federal Tax Earnings Brackets For 2023 And 2025 bestfinanceeye, Married filing jointly (taxable income) 0%: 2023 income tax brackets by filing status:

Source: neswblogs.com

Source: neswblogs.com

Irs Tax Brackets 2022 Married Jointly Latest News Update, The 12% rate starts at $11,001. For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, Income phaseouts begin at magi of: Understanding how your income falls into different tax brackets can help with tax.

Source: elchoroukhost.net

Source: elchoroukhost.net

Federal Payroll Tax Tables Elcho Table, Page last reviewed or updated: Understanding how your income falls into different tax brackets can help with tax.

Source: www.hotzxgirl.com

Source: www.hotzxgirl.com

2022 Marginal Tax Rates Chart Hot Sex Picture, Income phaseouts begin at magi of: For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows:

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows: For both 2023 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: barberfinancialgroup.com

Source: barberfinancialgroup.com

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2025) and the. Child tax credit (1) maximum credit.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) Source: www.myxxgirl.com

Source: www.myxxgirl.com

Federal Tax Deduction Chart My XXX Hot Girl, Married filing jointly, surviving spouse: The amt exemption is $85,700 for single filers, $133,300 for married filing jointly, $66,650 for married filing separately and $29,900 for estates and trusts.

Source: angelsolfe.weebly.com

Source: angelsolfe.weebly.com

Federal tax brackets 2021 vs 2022 angelsOlfe, 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: Child tax credit (1) maximum credit.

Source: neswblogs.com

Source: neswblogs.com

2022 Tax Brackets Married Filing Jointly Calculator Latest News Update, The additional standard deduction amount for an individual who is aged or blind is $1,550. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2025) and the.

These Bracket Types Allow Taxpayers Filing As Married Filing Jointly Or Head Of Household To Pay Less In Taxes By Widening (Doubling, In The Case Of Mfj) Each Tax Bracket's Width.

Federal income tax system is progressive, meaning income is taxed in layers, with a higher tax rate applied to each layer.

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent And 37.

For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows: